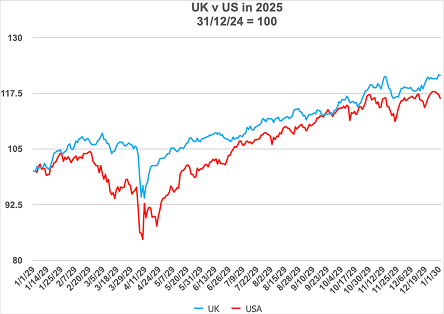

Investment performance in 2025 delivered an unexpected result. Despite widespread confidence in continued US market dominance, it was the UK market that ultimately came out on top.

Source: Investing.com – FTSE 100 vs S&P 500

A Year Dominated by US Narratives

Throughout 2025, it was difficult to avoid the perception that the US was once again leading global markets. Much of this narrative stemmed from the unpredictability of Donald Trump and renewed focus on US economic policy.

At the same time, artificial intelligence (AI) captured investor attention, driven by US mega-cap companies closely associated with the technology. Firms such as Google and semiconductor giant Nvidia dominated headlines. At one point during the year, Nvidia’s valuation exceeded $5 trillion—greater than the total value of the entire UK stock market.

Market Performance: UK Outshines the US

The US stock market, measured by the S&P 500, reached an impressive 38 new record highs during 2025 and ended the year up 16.4%.

However, despite this strong performance, it was surpassed by the UK’s FTSE 100, which rose by 21.5% over the same period.

Unexpected Drivers of UK Strength

Ironically, the sectors that helped propel the FTSE 100 ahead in 2025 were some of the same areas that had previously held it back. Banking stocks—accounting for more than 15% of the index—benefitted from falling interest rates, while natural resource companies gained from sharp increases in commodity prices.

Rising prices for gold, silver and copper supported mining stocks, with the standout performer being Fresnillo. Incorporated and listed in London, Fresnillo saw its share price rise by more than 430% during the year.

Currency Movements Tell a Deeper Story

The headline index numbers only reveal part of the picture. In 2025, the US dollar weakened significantly, losing 9.4% against a trade-weighted basket of currencies. A weaker dollar was consistent with President Trump’s stated preference, whether achieved deliberately or otherwise.

Sterling strengthened by 7.7% against the dollar, meaning that once US market returns were converted into pounds, the S&P 500’s 16.4% rise fell to just 8.1% in sterling terms.

Dividends Tip the Balance Further

Index performance figures exclude dividends, and this is another area where the UK market had an advantage. UK equities have traditionally offered higher dividend yields than their US counterparts.

When dividends are included, the total return for the FTSE 100 in 2025 rises to 25.8%, compared with 17.9% for the S&P 500 (in dollar terms). This widened the gap between the two markets even further.

The Investment Lesson From 2025

The key takeaway from 2025 is the importance of focusing on hard data rather than market noise. Popular narratives, media attention and investor sentiment do not always align with actual outcomes.

Diversification, valuation discipline and an understanding of currency and income effects all remain crucial components of long-term investment success.

If you would like to review how your portfolio is positioned—or ensure your investments remain aligned with your objectives and attitude to risk—the team at Chartwell Wealth Management is here to help. Our advisers can provide clear, personalised guidance to help you navigate changing markets with confidence. Please get in touch to arrange a review.

The value of investments and any income from them can go down as well as up, and you may not get back the full amount invested.

Past performance is not a reliable indicator of future performance.

Investing in shares should be regarded as a long-term investment and should fit in with your overall attitude to risk and financial circumstances.