A Significant Shift in ISA Subscription Trends

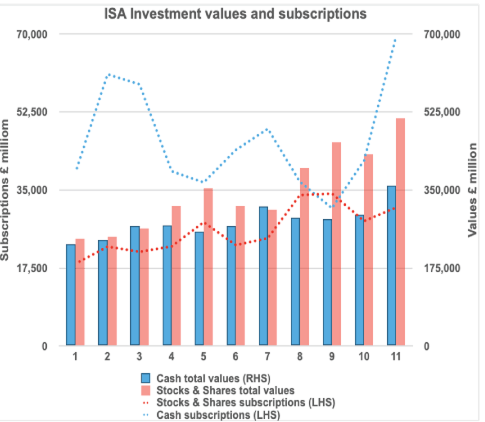

Recent HMRC figures for the 2023/24 tax year reveal a notable trend: cash ISA subscriptions rose at a much faster pace than stocks and shares ISAs — around 224% more by the end of the decade.

With cash ISAs attracting the majority of new money, the future direction of ISA policy has become a focal point for the Chancellor.

Government Plans to Reform the ISA Landscape

Why the ISA System Is Under Review

Chancellor Rachel Reeves has long signalled her intention to reform Individual Savings Accounts (ISAs) to “improve returns for savers.”

One of the most discussed possibilities is a reduction in the £20,000 annual subscription limit specifically for cash ISAs.

Unsurprisingly, this has sparked debate across the financial sector:

-

Investment managers generally welcome reforms that might shift savers toward investment-based ISAs.

-

Banks and building societies, however, oppose changes that could restrict inflows into cash ISAs.

What the Latest HMRC Data Tells Us

The Growing Dominance of Cash ISAs

HMRC’s statistics published in September highlight the current picture:

-

Cash ISA subscriptions (2023/24): £69.5 billion

-

Stocks & Shares ISA subscriptions (2023/24): just over £31 billion

-

Total cash ISA holdings (April 2024): £360 billion, now likely exceeding £400 billion

This enormous volume has clear implications for tax revenue. For example, if £400 billion earns interest at a 4% Bank Rate, that equates to £16 billion of untaxed interest income.

HMRC now estimates the overall cost of ISA tax relief—both income tax and capital gains tax—at £9.4 billion in 2024/25, nearly 20% higher than the previous year.

From the Treasury’s perspective, limiting cash ISA inflows could help reduce this growing tax loss.

Are Cash ISAs Really Delivering Better Returns?

The Long-Term Growth Picture

Reeves’s argument isn’t without merit. HMRC’s data also shows that over the decade to April 2024, the total value of stocks and shares ISAs grew more rapidly than that of cash ISAs.

It’s important to remember why:

From 2009 to mid-2022, the Bank of England base rate remained at or below 1%, meaning cash savers received minimal returns for over a decade. Only in recent years have interest rates risen enough to make cash ISAs more appealing again.

Should You Move Money into a Cash ISA Before the Budget?

Consider Your Goals First

Before rushing to open or top up a cash ISA ahead of potential reforms, think carefully about what you want to achieve.

If your goal is simply to shelter cash savings from tax, remember the Personal Savings Allowance (PSA) may already cover much or all of your interest:

-

Basic-rate taxpayers: £1,000 PSA (worth up to £200 in tax saved)

-

Higher-rate taxpayers: £500 PSA

-

Additional-rate taxpayers: No allowance

For many people, the PSA already protects a meaningful amount of interest without needing an ISA.

When Stocks and Shares ISAs May Be a Better Fit

A Long-Term Investment Opportunity

For savers aiming for long-term growth, the Chancellor’s suggestion has weight: stocks and shares could offer stronger potential returns over time.

However, investing is not suitable for everyone. Key considerations include:

-

Investments can rise and fall, and you may get back less than you originally invested.

-

Investing should align with your risk tolerance, financial goals, and time horizon.

-

Stocks & Shares ISAs invest in assets that fluctuate in value, such as shares and corporate bonds.

-

While investors don’t pay personal tax on ISA income or gains, some underlying income may have unrecoverable tax paid by ISA managers.

-

Tax treatment differs by individual circumstances and could change in the future.

-

The Financial Conduct Authority does not regulate tax advice.

Speak to Chartwell Wealth Management

Whether you’re considering a cash ISA, exploring investment options, or reviewing your overall tax efficiency, personalised advice can make all the difference.

Chartwell Wealth Management is here to help you make informed, confident decisions about your financial future.

Contact us today to discuss your ISA strategy and ensure your money is working as effectively as possible.