Recent rule changes from HMRC mean that a form of crypto-related investment fund has now become eligible for inclusion within an ISA — a notable development in the UK’s cautious approach to cryptoassets.

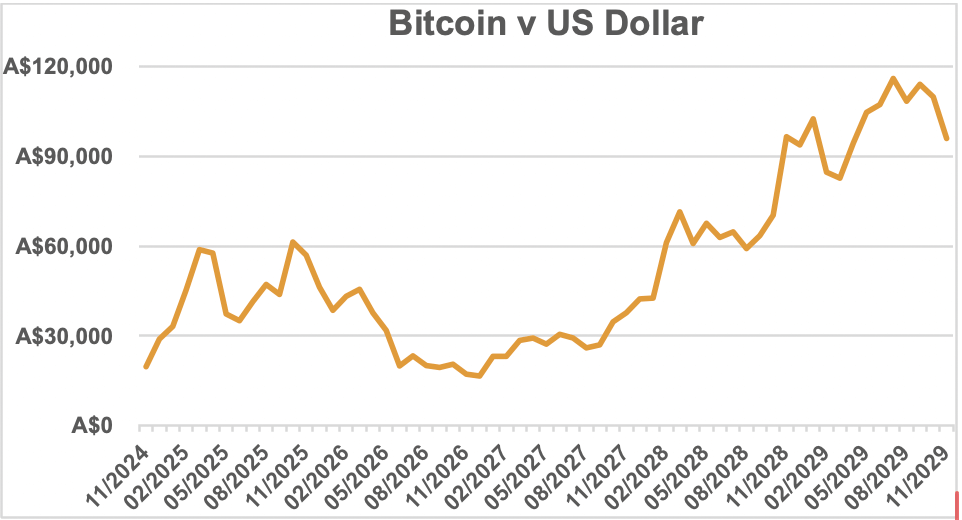

Source: Investing.com

Cryptoassets: From Fringe to Financial Headlines

Over recent years, cryptoassets have captured widespread attention. From Bitcoin and stablecoins to high-profile non-fungible tokens (NFTs) such as Bored Ape Yacht Club, digital assets have increasingly featured in both mainstream media and investment discussions.

Political developments in the United States have added further momentum. The return of Donald Trump to the White House has boosted sentiment across the crypto sector, despite his earlier comments during his first term describing cryptocurrencies as “not money” and having value that was “highly volatile and based on thin air”.

In a marked shift, President Trump is now reported to have personally earned millions of dollars from World Liberty Financial, a cryptocurrency business established by his sons in September 2024.

The UK’s More Reserved Approach to Crypto

Across the Atlantic, the UK’s relationship with cryptoassets looks very different. There is no equivalent to the TRUMP meme coin — launched just days before the start of Trump’s second term — and little evidence of political enthusiasm for retail crypto adoption.

While former Chancellor Rishi Sunak once stated his ambition to make the UK a “global cryptoasset technology hub”, progress towards that goal has been limited. Instead, regulatory caution has remained the dominant theme.

FCA Caution and the ETN Ban

The UK’s financial regulator, the Financial Conduct Authority (FCA), has spent much of the past decade expressing concerns about cryptoassets, which have largely been treated as unregulated investments.

In October 2020, the FCA announced a ban on crypto-linked Exchange Traded Notes (ETNs), stating:

“The FCA considers these products to be ill-suited for retail consumers due to the harm they pose. These products cannot be reliably valued by retail consumers because of the inherent nature of the underlying assets, which means they have no reliable basis for valuation.”

This position effectively excluded crypto ETNs from mainstream retail investment portfolios.

A Regulatory Reversal — With Conditions

Almost five years later, the FCA has lifted its ban on crypto ETNs. In response, HMRC confirmed that these products would immediately become eligible for inclusion within Stocks and Shares ISAs.

However, this change comes with a significant caveat. HMRC has also announced that after 5 April 2026, crypto ETNs will no longer be eligible for Stocks and Shares ISAs. Instead, they will only be permitted within Innovative Finance ISAs — a niche ISA category offered by relatively few providers.

This creates a limited window for investors considering crypto exposure within an ISA wrapper.

A Reminder on Risk and Valuation

For those tempted to include crypto investments within their ISA, it is worth revisiting the FCA’s original warning: cryptoassets have no reliable basis for valuation. Their prices can be extremely volatile, driven by sentiment rather than fundamentals, and may not be suitable for many investors — particularly when used as part of a long-term financial plan.

Speak to Chartwell Wealth Management

Regulatory changes can open up new opportunities, but they can also introduce new risks. Before making decisions about crypto investments — especially within tax-efficient wrappers such as ISAs — it is important to understand how they fit within your wider financial goals and risk tolerance.

If you would like professional guidance on ISA investing, portfolio construction, or whether alternative assets such as crypto have a place in your financial strategy, please contact Chartwell Wealth Management. Our advisers can help you make informed decisions aligned with your long-term objectives.

Important Information

Investing in shares should be regarded as a long-term investment and should fit with your overall attitude to risk and financial circumstances.

The value of investments and the income from them can fall as well as rise, and investors may not get back the amount originally invested.

Investors do not pay personal tax on income or gains within an ISA, although unrecoverable tax may be deducted on income received by ISA managers.

Stocks and Shares ISAs invest in corporate bonds, stocks and shares and other assets that fluctuate in value.

Tax treatment depends on individual circumstances and may change in the future.

The Financial Conduct Authority does not regulate tax advice.