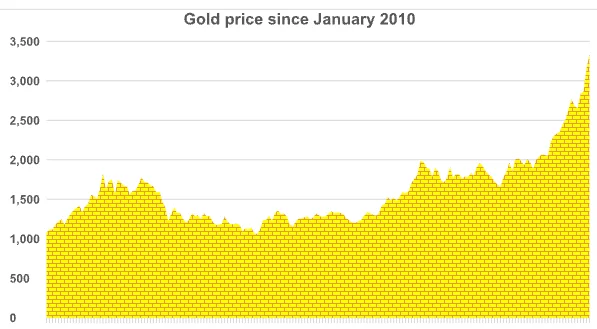

Evaluating Gold as an Investment

At first glance, the proposition of investing in an asset exhibiting limited practical utility, generating no direct income, and incurring ownership costs such as insurance and storage, might appear counterintuitive. Such criticisms are frequently levelled against the strategy of purchasing and holding physical gold.

Source: Investing.com

Market Dynamics and the Impact of Geopolitical Factors

Adding to these conventional critiques is a peculiar aspect of the gold market, recently highlighted by the looming possibility of tariffs under President Trump’s administration. In anticipation of the designated ‘Liberation Day’, a notable surge in the physical importation of gold into the United States occurred to circumvent potential tariffs. Typically, gold investment transactions involve changes in ownership without the physical movement of bullion, which often remains within established vaults like those of the Bank of England in London. However, the prospective tariff created a valuation disparity, rendering gold delivered within the U.S. more valuable than gold held elsewhere, which might be subject to import duties at a later stage.

Logistical Challenges in a Globalised Market

The seemingly straightforward process of transporting gold from London to New York, notwithstanding security considerations and the imperative to meet the April 2nd ‘Liberation Day’ deadline, presented significant logistical hurdles. London serves as the primary hub for physical gold trading, involving the buying and selling of standard bars. In contrast, the New York Comex market primarily focuses on derivatives, such as futures contracts. These distinct markets operate with different standard gold bar weights. The prevalent UK ingot typically weighs 400 troy ounces (approximately 12.5 kilograms), whereas the standard New York bar is a more manageable 1 kilogram.

The Journey of Gold and Subsequent Market Repercussions

This disparity in standards precipitated an unusual sequence of events. Bullion acquired in London for delivery in New York was initially routed to Switzerland for melting and recasting into the smaller, U.S.-standard ingot size. In an era characterised by instantaneous electronic trading, this physical transformation appears paradoxical. Nevertheless, this process unfolded during the first three months of 2025. This unprecedented ‘gold rush’ eventually necessitated the use of air transport to expedite the delivery of the resized bars to the United States before the anticipated tariff implementation.

Ultimately, on April 2nd, President Trump announced an exemption for gold from the proposed tariffs.

This reprieve initially triggered a price decline in gold to below $3,000 per ounce, followed by a subsequent rebound to a new record high, exceeding $3,400 by mid-April. This price surge was likely also influenced by Trump’s policies, as some investors at that time perceived gold as a more secure store of value compared to the U.S. dollar.

The value of your investment and any income from it can go down as well as up and you may not get back the full amount you invested.

Past performance is not a reliable indicator of future performance.

Concerned About Tariffs and Your Investments?

If the volatility surrounding Trump’s tariffs has you questioning the stability of your portfolio, or if you’re uncertain how to navigate the complexities of gold holdings in this fluctuating market, contact Chartwell Wealth Management today for tailored investment advice.