The Ingredients for the Next State Pension Increase

The ingredients to determine next April’s increase in the State pension are now clear and suggest a problem deferred until the 2026 Budget.

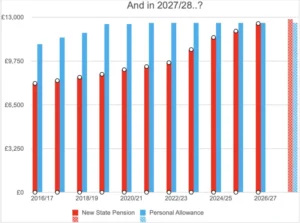

Source: DWP, HMRC

How the State Pension ‘Triple Lock’ Works

The basis for increases to the old and new State pension is the ‘triple lock’, which sets the change in April to be the greater of:

-

Earnings growth for the period May to July in the previous year,

-

Consumer Price Index (CPI) inflation to September of the previous year, or

-

2.5%.

The earnings growth figure, 4.7%, was published in mid-September. While the inflation data will not arrive until 22 October, prices would have to rise by an unlikely 0.9% between August and September for annual inflation to exceed 4.7%. That means State pensions should rise by 4.7%, unless the Office for National Statistics revises its earnings numbers.

| Pension | 2025/26 £ a week |

2026/27 £ a week |

Increase £ a week |

Increase £ a year |

|---|---|---|---|---|

| Old State | 176.45 | 184.75 | 8.30 | 431.60 |

| New State | 230.25 | 241.10 | 10.85 | 564.20 |

The Numbers for 2026

The new State pension, which applies to anyone reaching State pension age after 5 April 2016, will be equal to £12,537 a year from April 2026.

The income tax personal allowance is £12,570, as it has been since 2021/22. Given that the minimum State pension increase is 2.5%, and the personal allowance is frozen until at least 2028/29, this means that from April 2027, the new State pension will exceed the personal allowance and, all other things being equal, attract a small income tax liability.

Why This Matters

In practice, there are many people who already have a total State pension (including, for example, the State Second Pension) that exceeds their personal allowance. However, for the new State pension alone to surpass the personal allowance will be a significant milestone.

Politically, this will be unpopular — especially following the Winter Fuel Payment controversy. Once the State pension exceeds the personal allowance, there is no going back unless the personal allowance rises faster than inflation.

The HMRC Challenge

There are also administrative challenges ahead for HMRC, since the State pension is paid without PAYE tax deductions. This raises questions such as:

-

Will HMRC issue simple assessments to collect small amounts of income tax (under £100) from those who only receive the State pension?

-

How will this affect pensioners who are unused to filing returns?

What It Means for Retirement Planning

One important consideration for retirement planning is that if your State pension exceeds your personal allowance, any private pension income will become fully taxable.

Tax treatment varies according to individual circumstances and is subject to change. The Financial Conduct Authority does not regulate tax advice.

Plan Ahead with Chartwell Wealth Management

As State pensions edge closer to the personal allowance threshold, careful planning becomes more important than ever. At Chartwell Wealth Management, our advisers can help you understand how these changes may affect your retirement income, tax position, and long-term financial strategy.

📞 Contact Chartwell Wealth Management today for expert, tailored advice to help you make the most of your retirement.