The Inflation Illusion: Understanding the Disconnect Between Data and Reality

Inflation fell in 2024, reaching 2.5% compared to 4.0% in 2023. Yet, for many, this drop didn’t reflect their lived experience. Why the discrepancy?

The Economist’s View vs. Public Perception

At the end of 2022, UK inflation (CPI) stood at 9.2%, peaking at 11.1% that October. By the end of 2024, it had fallen to 2.5%, nearing the Bank of England’s 2% target. The US saw a similar trend. Despite these figures, the perceived cost of living played a significant role in the 2024 election outcomes in both countries, highlighting the difference between how economists and the public perceive inflation. Economists focus on the 12-month figure, while the public’s view is longer-term and influenced by specific price changes.

Those election results were a reminder that the economist’s view and the public’s view of inflation differ greatly. The economist has a strictly mathematical 12-month view, whereas public perceptions are longer term and often more focused on specific items. One way to understand this is to examine some of the detailed 2024 UK inflation annual figures and compare them with the three-year price increases (December 2021–December 2024).

Breaking Down the 2024 Figures

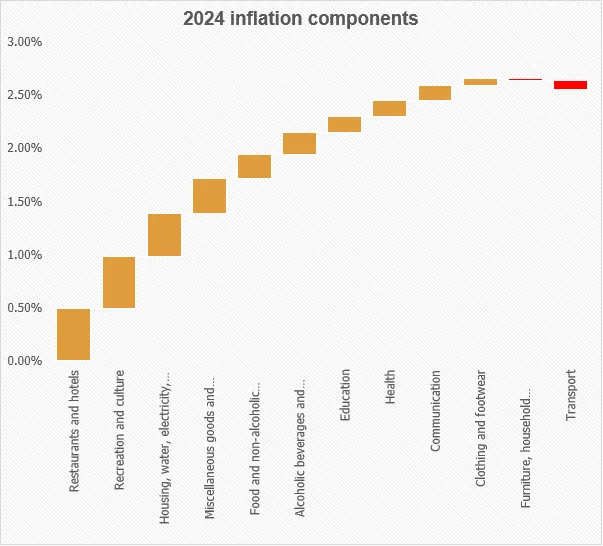

To understand this disconnect, let’s examine the 2024 UK inflation data alongside the three-year price increases (December 2021–December 2024):

- Overall In 2024, CPI inflation was, as we said, 2.6%. However, over the three years, prices had risen in total by 17.4%, equivalent to 5.5% a year.

- Food and non-alcoholic beverages This is a high-profile category, which has seen a whiplash pattern of inflation, soaring to 16.8% in 2022 and then plummeting to 2.0% in 2024. Over the three years, price increases totalled 28.7%, equivalent to 8.8% a year. Some items in this category experienced much sharper rises – oils and fats jumped nearly 56%.

- Restaurants and Hotels This is the largest category in the CPI, accounting for about one seventh of the total ‘shopping basket’. Over three years it was up 23.2%, while in 2024 it added 3.4%, making it the largest contributing category to 2024 inflation.

- Transport If you guess this, you will almost certainly be wrong. Over the three years, transport costs rose in total by just 5.4% and in 2024 they fell remarkably to 0.6%. Most people remember the pump price jumps of the Ukraine war, but forget their unwinding, helped by freezes on fuel duty.

Whichever way you think about inflation, make sure your financial planning takes it into consideration.

Confused by inflation’s impact on your finances?

Chartwell’s expert advisors can help you navigate these complex economic times. We’ll work with you to understand how inflation affects your specific situation and develop a financial plan to protect your future. Contact us today for a consultation.