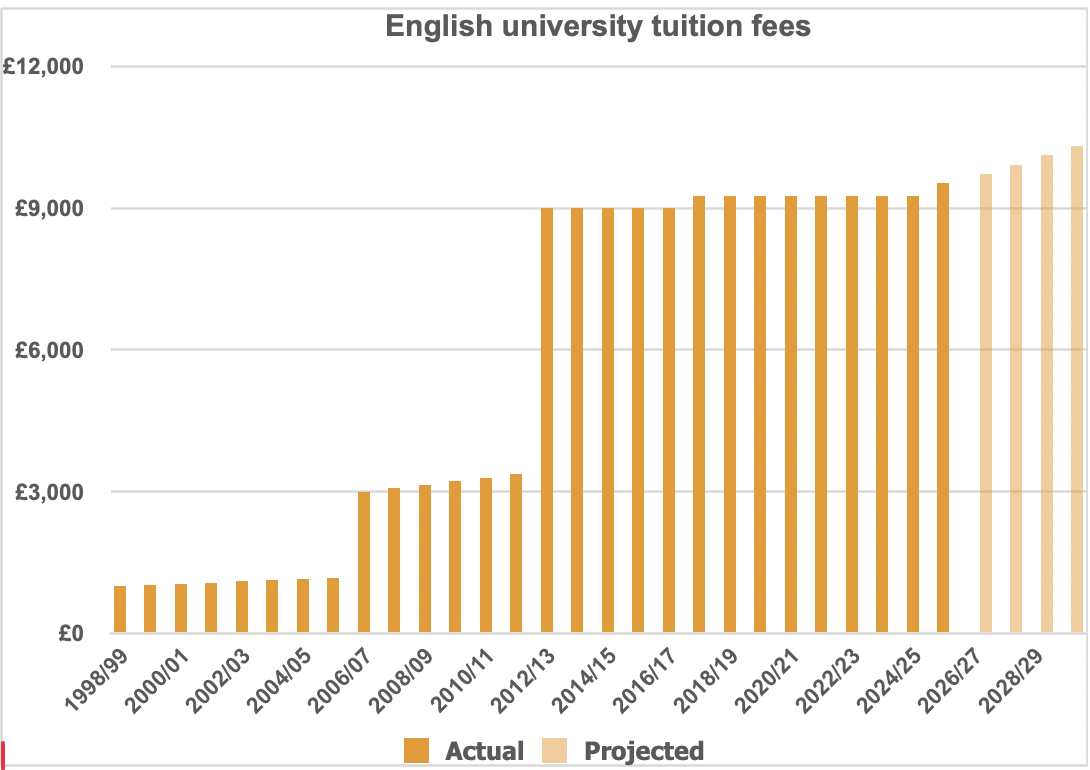

A recent government announcement has confirmed that university tuition fees in England are set to rise once again, placing additional long-term financial considerations on students and their families.

Post-16 Education Reform Takes Centre Stage

In October, the UK Government unveiled a package of reforms aimed at post-16 education. The headline announcement was the introduction of new ‘V Levels’ — vocational qualifications designed to align closely with real-world job standards.

These qualifications will form part of a broader ambition for two-thirds of young people to engage in higher-level learning — whether academic, technical or through apprenticeships — by the age of 25.

Tuition Fee Increases Fly Under the Radar

Alongside the focus on V Levels, the Department for Education (DfE) also confirmed a less-publicised but financially significant change.

Inflation-Linked Fee Rises

The DfE announcement confirmed that:

-

University tuition fees in England will rise in line with forecast inflation for the next two academic years.

-

Subject to new legislation, tuition fees will then automatically increase each year in line with inflation.

Even if inflation averages a relatively modest 2%, projections suggest that by the 2028/29 academic year, tuition fees in England will exceed £10,000 per year — ten times their original level when fees were introduced in 1998/99.

How England Influences the Rest of the UK

Tuition fees vary across the UK. For example, Scottish students attending Scottish universities do not pay tuition fees. However, England’s decisions still have a significant impact.

English tuition fee levels help set the tone nationally and directly affect students from Scotland, Wales and Northern Ireland who choose to study at universities outside their home nation.

Student Loans: The Plan 5 System Explained

The tuition fee announcement comes two years after a major overhaul of student loans for new undergraduates in England. Students who began their courses before the 2023/24 academic year were unaffected, but newer entrants are now covered by the Plan 5 loan system.

Key Features of Plan 5 Student Loans

Under Plan 5:

-

Repayments are set at 9% of income above £25,000, with the threshold frozen until at least 2027. Repayments begin in the April after leaving university.

-

Interest is charged at the Retail Price Index (RPI) rate each March (3.2% for 2025).

-

Any outstanding loan balance is written off after 40 years, or upon death.

These rules apply to both tuition fee and maintenance loans. For a new graduate, this could mean managing student debt of £60,000 or more over their working lifetime.

Should Families Pay Tuition Fees Up Front?

Rising tuition fees may prompt parents or grandparents to consider paying university costs upfront. However, this is not always the most financially sensible option. Given the structure of student loan repayments and eventual write-offs, paying fees directly could come at the expense of other long-term financial priorities.

Speak to Chartwell Wealth Management

With tuition fees rising and student loan rules becoming increasingly complex, careful financial planning has never been more important. Whether you are supporting a child or grandchild through higher education, understanding the long-term implications of funding decisions is crucial.

If you would like tailored advice on education funding, intergenerational planning, or balancing university costs with wider financial goals, please contact Chartwell Wealth Management. Our advisers can help you make informed decisions that support both your family and your financial future.