Recent HMRC data reveals that company cars are enjoying a revival, with a significant rise in electric vehicle (EV) adoption leading the charge.

The Comeback of Company Cars

A Rebound After Years of Decline

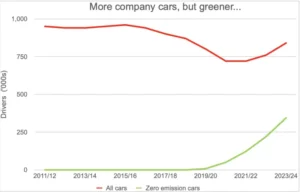

Between 2015/16 and 2020/21, company car ownership fell by 25%. However, the latest figures show a turnaround—largely thanks to the growing appeal of electric vehicles.

As recently as 2018/19, fewer than one in 200 company cars was a zero-emission vehicle. By 2023/24, that number had jumped to two in every five company cars.

At the same time, diesel’s dominance has faded dramatically, dropping from over two-thirds of company cars to just one in eight.

Why the Switch to Electric?

Tax Incentives Drive Change

The trend toward electric company cars is less about environmentalism and more about tax efficiency. Over the past decade, HMRC has reshaped company car taxation to favour low-emission vehicles.

-

2017 OpRA Reform:

HMRC introduced the Optional Remuneration Arrangement (OpRA) rules, making most salary sacrifice company car arrangements less tax-efficient. However, an exception was introduced for vehicles emitting 75g/km CO2 or less.

-

2020 Zero-Emission Incentive:

In 2020/21, the benefit-in-kind (BIK) rate for zero-emission cars was cut from 16% to 0%. It rose to 1% in 2021/22, 2% in 2022/23, and remains at 2% until the recent rise to 3% in 2025/26.

-

Comparison with Petrol Cars:

By contrast, a petrol car producing 100g/km of CO2 has seen its BIK rate barely move, from 24% in 2019/20 to 25% today.

The Financial Impact

The government’s tax incentives have been highly effective. The total taxable value of all company cars dropped from £5.43 billion in 2019/20 to £3.27 billion in 2023/24—a steep decline reflecting the switch to greener vehicles.

However, this favourable treatment will not last forever. By 2029/30, the BIK charge on zero-emission cars will rise to 9%, triple today’s rate. While salary sacrifice for electric cars may still be worthwhile, the tax advantage will be far less generous.

Key Considerations

-

Tax treatment depends on individual circumstances and may change in the future.

-

The Financial Conduct Authority does not regulate tax advice.

Next Steps: Making the Right Choice

At Chartwell Wealth Management, we help individuals and businesses make informed decisions about tax-efficient benefits, including company cars and salary sacrifice schemes.

Contact Chartwell Wealth Management today to discuss whether an electric company car could be a smart option for your financial planning.